Paramount+: A Contender in the Streaming Wars

The streaming landscape, once a tidy kingdom ruled by Netflix, has exploded into a fierce, fragmented battlefield. In this crowded arena, Paramount+ has emerged not as a mere participant but as a strategic and surprisingly resilient contender. More than just a rebranded service, it represents the ambitious digital future of one of Hollywood’s most storied empires—Paramount Global (formerly ViacomCBS). Its journey is a fascinating case study in leveraging legacy assets, navigating corporate synergy, and carving out a unique identity in a market dominated by giants.

From CBS All Access to a Global Powerhouse

Paramount+’s origins are humble. It was launched in March 2021 as a direct evolution of CBS All Access, a service that began in 2014. That platform was primarily a vehicle for live CBS broadcasting and a deep library of procedural hits like NCIS and CSI. While it had early successes with original programming like The Good Fight, its scope was limited. The rebrand to Paramount+ was a declaration of intent. It signified a shift from a network-centric service to a full-fledged, studio-driven streaming platform, pulling content from every corner of Paramount Global’s vast portfolio: CBS, Paramount Pictures, Nickelodeon, MTV, Comedy Central, BET, and the Smithsonian Channel.

This aggregation is Paramount+’s foundational strength. It didn’t have to build a library from scratch; it inherited a century’s worth of iconic film and television. The service’s content strategy is built on this “four-quadrant” appeal, aiming to reach every household demographic.

The Content Pillars: Franchises, Nostalgia, and Event Television

Paramount+ has strategically organized its original and library content around distinct, mighty pillars:

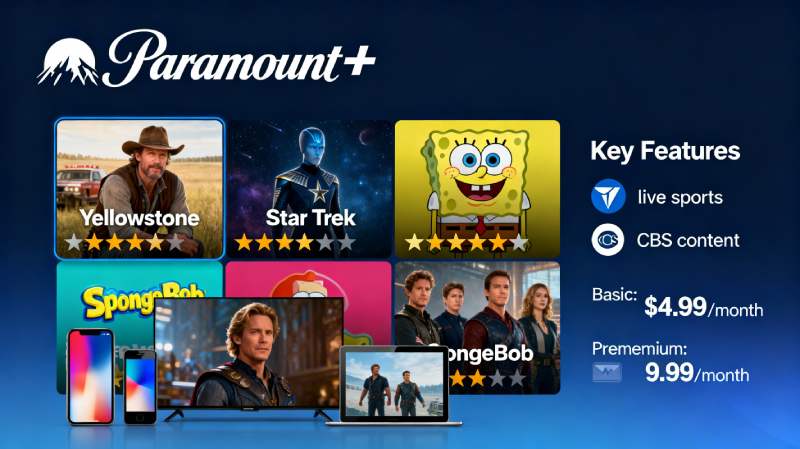

- The “Sprawlerverse” and Blockbuster Franchises: This is Paramount+’s headline-grabbing advantage. The service is the exclusive streaming home for new Paramount Pictures films just 45 days after their theatrical run, a window that brings major blockbusters to subscribers quickly. More importantly, it has become the breeding ground for franchise extensions. The Star Trek universe has found its natural home here, with series like Strange New Worlds, Picard, and Lower Decks catering to a dedicated fanbase. Similarly, the successful expansion of the Yellowstone universe with prequels like *1883* and *1923* (as Paramount+ originals) demonstrated a masterful strategy of using a cable megahit to drive streaming subscriptions. The planned development of films from the Transformers and G.I. Joe franchises further cements this pillar.

- Nickelodeon & Family Content: In the fight for family wallets, Paramount+ holds a formidable weapon. The inclusion of thousands of episodes from Nickelodeon’s library—from SpongeBob SquarePants and Rugrats to Blue’s Clues—makes it a one-stop shop for children’s entertainment. Original revivals like the Rugrats reboot and iCarly sequel series smartly tap into millennial nostalgia while engaging a new generation.

- Reality & Unscripted Dominance: While other streamers focused heavily on scripted prestige, Paramount+ leveraged MTV, Comedy Central, and CBS to dominate the reality space. The service offers vast libraries of iconic series, including The Daily Show, Jersey Shore, and Love Island. Its original reality offerings, such as the Real World Homecoming reunions and the streaming-first The Challenge series, create a sticky ecosystem for fans of unscripted content.

- CBS’s Reliable Engine: The backbone of live news and sports (like NFL games and UEFA Champions League) and a constant pipeline of popular, broad-appeal scripted series from CBS Studios (SEAL Team, Evil, The Good Fight) provide a steady, reliable flow of content that appeals to a traditionally broadcast audience, easing their transition to streaming.

The Global Strategy and Challenges

Paramount+ has pursued an aggressive international rollout, often bundling the service with its ad-supported tier, Pluto TV (a free, FAST service it owns), to create a one-two punch of premium and free content. This dual approach is clever, capturing both subscription dollars and advertising revenue across different market segments.

However, the service faces significant challenges. The first is scale. With just over 70 million subscribers (as of late 2024), it still trails far behind Netflix, Disney+, and Amazon Prime Video. The streaming market is saturated, and customer loyalty is fickle. The second is the content conundrum. While its franchises are strong, the cost of producing tentpole series and films to compete with Disney’s Marvel or Lucasfilm budgets is immense. Paramount Global is not as large as its tech-backed competitors, leading to periodic Wall Street scrutiny over its streaming investments and profitability.

Furthermore, the corporate structure can be a double-edged sword. The synergy between film, TV, and streaming is a strength, but it also leads to complex licensing legacies. For years, key Paramount films were licensed to competitors (e.g., South Park to HBO Max, many films to Netflix and Epix). While the strategy is now to reclaim IP for Paramount+, it creates a transitional period where the service’s library can feel incomplete compared to its more entrenched rivals.

The Road Ahead: Niche or Broad?

The future of Paramount+ hinges on a critical question: can it remain a broad, four-quadrant service, or will it need to hone a more specific niche to ensure sustainability? Its current path suggests a hybrid model. It aims for breadth through its legacy library and CBS’s mass appeal, while using its franchise depth and reality TV dominance as defensible, subscriber-specific niches.

Key to its strategy will be continuing to execute on its franchise expansions without oversaturating them, maintaining its unique voice in reality programming, and leveraging live sports as an unbeatable churn-reduction tool. Its partnership with Walmart, offering the ad-supported tier to the retailer’s subscription members, is an example of an innovative, low-cost-to-acquire-customer growth tactic.

In Conclusion

Paramount+ is more than a streaming service; it is the digital manifestation of a classic media conglomerate fighting for relevance in the 21st century. It lacks the bottomless pockets of Apple or Amazon, the sheer volume of Netflix, or the singular brand focus of Disney. Yet, through astute management of its deep well of beloved IP, strategic franchise extension, and a clear understanding of its diverse audience segments, it has secured a vital spot in the streaming hierarchy. It may not be the king of the hill, but in the volatile streaming wars, Paramount+ has proven it is a tenacious and clever warrior with the assets and strategy to remain a formidable player for years to come. Its success will be a defining chapter in the story of how traditional Hollywood adapted, survived, and potentially thrived in the streaming era.